A new generation banking experience full of privileges

Transfers to Turkey

View Details

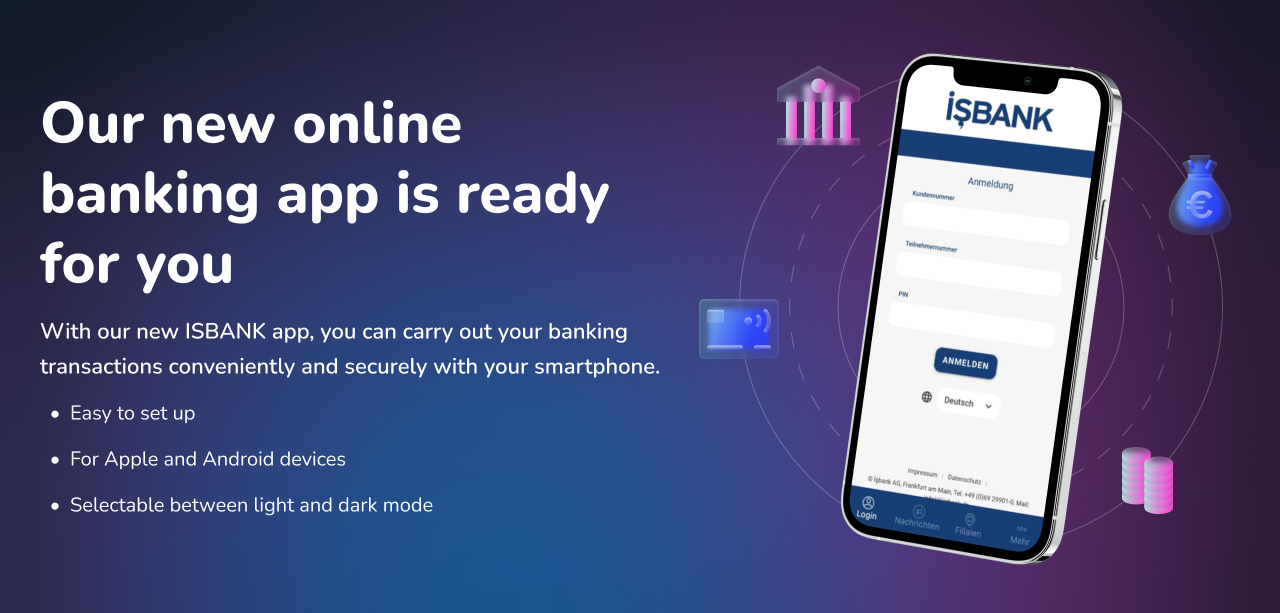

Online Banking

View Details

Fixed-rate savings account

View Details

Business Account

View DetailsNew to online banking? - Your advantages at a glance!

-

Transfers to Turkey

-

EU standard and domestic transfersn

-

Standing orders

-

Scheduled and collective transfers

-

Overview of your account transactions

Fixed-rate savings account - Invest money safely with us

Excellent returns

Very high level of security, excellent for planning

Free of charge

Small minimum deposit

Frequently Asked Question

⠀

İşbank has been present in Europe for over 30 years with all services and products focused on corporate finance. Furthermore, our product range in the private and corporate customer business includes account management including online banking, savings and time deposits at attractive interest rates and the entire range of payment transactions including Turkey transfers.

⠀

The İşbank AG is wholly-owned subsidiary of the in 1924 founded Türkiye İş Bankası A.Ş., the largest private bank in Turkey with more than 1.200 branches. The bank is a result from the in 1992 founded İşbank GmbH and it changed to a public company by the german law in force in 2012 and was filed on 2.8.2012 by the trade register of Frankfurt am Main as document number HRB 94361.

⠀

İşbank is headquartered in Frankfurt am Main and is active across Europe with 8 branches in Germany and one additional branch in the Netherlands.

⠀

Deposits with İşbank AG are insured within the scope of the EdB, which is a statutory deposit protection scheme. As of 1 January 2011, the EdB covers deposits of up to 100,000 euros per investor. Furthermore, İşbank AG is also a member of the Federal Association of German Banks’ Deposit Protection Fund.

⠀

As

of January 1, 2023, caps on the scope of protection will apply for the first

time. These are based on the protection requirements of depositors.

Accordingly, from January 1, 2023, the scope of protection for private savers

will be five million euros and for companies 50 million euros. These limits

will be adjusted to three million euros for private customers and 30 million

euros for companies from January 1, 2025. Once the reform is fully implemented

in 2030, the level of protection will be one million euros for savers and ten

million euros for companies. Further information on the deposit protection fund

is available at www.einlagensicherungsfonds.de.